Contents

- 1 Introduction: Why Your Money Today is Worth More Than Tomorrow

- 2 What Exactly is Time Value of Money?

- 3 The Five Essential Components of TVM

- 4 The Mathematical Magic: Essential TVM Formulas

- 5 How to Use Our TVM Calculator: A Step-by-Step Guide

- 6 Real-World Applications: TVM in Action

- 7 Powerful Investment Strategies Using TVM Principles

- 8 Common TVM Mistakes to Avoid

- 9 Advanced TVM Concepts

- 10 Frequently Asked Questions

- 11 Conclusion: Take Control of Your Financial Future

Introduction: Why Your Money Today is Worth More Than Tomorrow

Have you ever wondered why financial experts always emphasize starting to invest early? Or why receiving $10,000 today is better than getting the same amount five years from now? The answer lies in a fundamental financial concept called the Time Value of Money (TVM).

Understanding TVM isn’t just for Wall Street analysts or financial planners—it’s essential for anyone who wants to make informed decisions about savings, investments, loans, and retirement planning. In this comprehensive guide, we’ll demystify TVM and show you how to use our powerful TVM calculator to take control of your financial future.

What Exactly is Time Value of Money?

Time Value of Money (TVM) is the core principle that money available today is worth more than the identical sum in the future due to its potential earning capacity. This simple yet powerful concept forms the foundation of all modern finance.

The Core Principle Explained

Think of it this way: if you have $100 today, you can invest it and earn interest. In one year, that $100 might grow to $105. Therefore, $100 today is equivalent to $105 in one year (assuming a 5% return). This earning potential makes money more valuable today than in the future.

Real-world example: If someone offered you $10,000 today or $10,000 in three years, you should always choose to take the money today. Why? Because you could invest that $10,000 and potentially turn it into $11,576 in three years (assuming a 5% annual return).

The Five Essential Components of TVM

To master TVM calculations, you need to understand these five key components:

1. Present Value (PV)

- What it is: The current value of a future sum of money

- Why it matters: Helps you understand what future money is worth today

- Example: The value today of $10,000 you’ll receive in 5 years

2. Future Value (FV)

- What it is: The value of current money at a specified date in the future

- Why it matters: Shows how your investments can grow over time

- Example: What your $10,000 investment will be worth in 10 years

3. Interest Rate (I/Y)

- What it is: The percentage rate at which money grows each period

- Why it matters: Determines how quickly your money compounds

- Example: 5% annual interest rate on your savings

4. Number of Periods (N)

- What it is: The time over which money is invested or borrowed

- Why it matters: Time is a critical factor in compound growth

- Example: 10 years until retirement

5. Payment Amount (PMT)

- What it is: Regular payments made or received during the time period

- Why it matters: Accounts for ongoing contributions or withdrawals

- Example: $200 monthly contributions to your retirement account

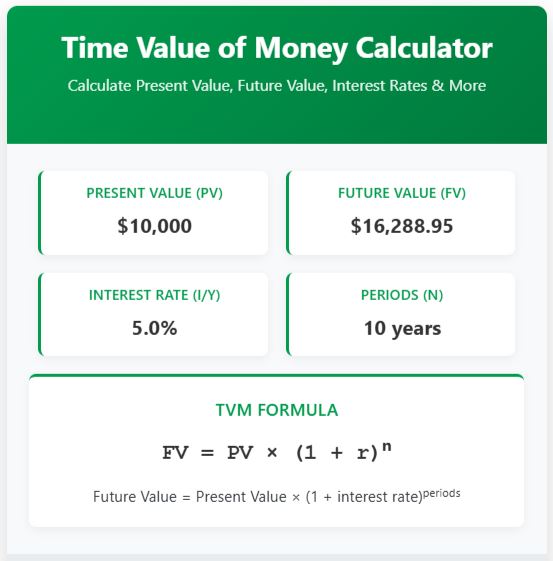

The Mathematical Magic: Essential TVM Formulas

While our TVM calculator handles the complex math for you, understanding the basic formulas helps you appreciate how the calculations work.

Future Value of a Single Sum

Formula: FV = PV × (1 + r)^n

This calculates how much a current investment will be worth in the future.

Practical example: If you invest $10,000 today at 6% annual interest for 10 years:

- FV = $10,000 × (1 + 0.06)^10

- FV = $10,000 × 1.7908

- FV = $17,908

Your $10,000 investment would grow to nearly $18,000 in 10 years!

Present Value of a Future Sum

Formula: PV = FV / (1 + r)^n

This determines what future money is worth today—crucial for evaluating investments.

Practical example: If you’re promised $20,000 in 8 years with a 5% discount rate:

- PV = $20,000 / (1 + 0.05)^8

- PV = $20,000 / 1.4775

- PV = $13,538

That future $20,000 is only worth about $13,538 in today’s dollars.

How to Use Our TVM Calculator: A Step-by-Step Guide

Our intuitive TVM calculator makes complex financial calculations simple. Here’s how to get the most out of it:

Step 1: Identify Your Goal

Determine what you want to calculate:

- How much to save for retirement (solving for PMT)

- How long until you reach your financial goal (solving for N)

- What interest rate you need to achieve your target (solving for I/Y)

- How much your current savings will grow (solving for FV)

- What a future amount is worth today (solving for PV)

Step 2: Enter Known Values

Fill in the values you know for four of the five TVM components.

Step 3: Leave One Field Empty

The calculator will automatically solve for the empty field.

Step 4: Adjust Advanced Settings

- Compounding frequency: Choose how often interest compounds (annually, monthly, daily)

- Payment timing: Select whether payments occur at the beginning or end of each period

Step 5: Analyze Your Results

Use the insights to inform your financial decisions and adjust your strategy as needed.

Real-World Applications: TVM in Action

Retirement Planning

Scenario: You’re 35 years old and want to retire at 65 with $1,000,000. You currently have $50,000 saved and expect a 7% annual return.

TVM calculation: How much do you need to save each month?

- PV: $50,000

- FV: $1,000,000

- N: 30 years

- I/Y: 7% annually

- Result: You need to save approximately $675 per month

Mortgage Decisions

Scenario: You’re considering a $300,000 mortgage at 4% interest for 30 years.

TVM calculation: What’s your monthly payment?

- PV: $300,000

- I/Y: 4% annually

- N: 30 years

- Result: Your monthly payment would be approximately $1,432

Investment Evaluation

Scenario: You have $15,000 to invest and want to know what it will be worth in 20 years with an 8% return.

TVM calculation: Future value of your investment

- PV: $15,000

- I/Y: 8% annually

- N: 20 years

- Result: Your investment could grow to approximately $69,914

Powerful Investment Strategies Using TVM Principles

The Magic of Starting Early

The single most important factor in building wealth is time. Thanks to compound interest, starting early can make a dramatic difference:

Example: Sarah starts investing $300 per month at age 25, while John starts investing the same amount at age 35. Both earn 7% annually and retire at 65.

- Sarah’s total contribution: $144,000

- John’s total contribution: $108,000

- Sarah’s retirement fund: $567,000

- John’s retirement fund: $244,000

Despite contributing only $36,000 more, Sarah ends up with over twice as much money—all because she started ten years earlier.

The Power of Consistent Contributions

Regular investing harnesses the power of dollar-cost averaging and compound growth:

Strategy: Set up automatic monthly contributions to your investment accounts. Even small amounts add up significantly over time.

Smart Debt Management

TVM principles also apply to debt repayment:

- Pay off high-interest debt first (it’s growing fastest)

- Understand the true cost of long-term loans

- Make extra payments early in the loan term to save significantly on interest

Common TVM Mistakes to Avoid

1. Ignoring Compounding Frequency

Many people assume annual compounding when their investments actually compound monthly or daily. This can significantly underestimate your growth.

2. Forgetting About Inflation

Always consider real returns (nominal return minus inflation) for long-term planning. A 6% return with 2% inflation is really a 4% real return.

3. Underestimating Time Horizons

Be realistic about how long you’ll keep money invested. Small differences in time can dramatically impact results.

4. Overlooking Tax Implications

Taxes can significantly impact your actual returns. Consider tax-advantaged accounts like IRAs and 401(k)s.

5. Using Incorrect Payment Timing

Annuity due (payments at beginning of period) calculations differ from ordinary annuity (payments at end of period) calculations.

Advanced TVM Concepts

Net Present Value (NPV)

NPV helps evaluate investment opportunities by calculating the present value of all future cash flows. Investments with positive NPV are generally worthwhile.

Internal Rate of Return (IRR)

IRR is the interest rate that makes the NPV of all cash flows equal to zero. It’s useful for comparing different investment opportunities.

Perpetuities

These are streams of equal payments that continue forever. While rare in practice, the concept helps understand valuation principles.

Frequently Asked Questions

How does TVM relate to compound interest?

TVM is the broader concept that encompasses compound interest. Compound interest is the mechanism that creates the time value of money—it’s how money grows over time.

Should I use nominal or real interest rates in TVM calculations?

For long-term planning, use real interest rates (nominal rate minus inflation rate). This gives you a clearer picture of your actual purchasing power over time.

How often should I recalculate my TVM projections?

Review your TVM calculations at least annually or whenever your financial situation changes significantly (new job, inheritance, major purchase).

Can TVM help with paying off debt?

Absolutely! TVM calculations can show you how much interest you’ll save by making extra payments or paying off high-interest debt first.

What’s the most important TVM factor for building wealth?

Time is the most critical factor. The earlier you start investing, the more time compound interest has to work in your favor.

Conclusion: Take Control of Your Financial Future

Understanding the Time Value of Money is like having a superpower for your financial life. It transforms how you think about saving, investing, borrowing, and planning for the future. With this knowledge and our TVM calculator, you’re equipped to make smarter financial decisions that can significantly impact your wealth over time.

Remember these key takeaways:

- Money today is always worth more than money tomorrow

- Time is your most valuable asset in building wealth

- Small, consistent investments can grow into substantial sums

- Compound interest is the most powerful force in personal finance

- Regular review and adjustment of your financial plan is essential

The best time to start applying TVM principles was yesterday—the second-best time is today. Use our TVM calculator to explore different scenarios, set realistic financial goals, and create a roadmap to the future you deserve.